Scheduler Training

Use the Online Scheduling System SimplyBook:

A SimplyBook interface is located on the homepage and schedule page on our website: http://www.psuvita.org/schedule-protected.html

A SimplyBook interface is located on the homepage and schedule page on our website: http://www.psuvita.org/schedule-protected.html

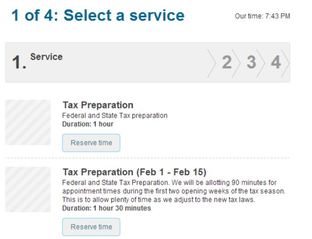

The scheduling service is currently offering "four" services. Technically there is no difference in the service but we will be allowing an extra 30 minutes for our volunteers to prepare the returns during the first two weeks of operation. When receiving calls from tax payers please alert them to this 1.5 hour time frame.

The drop off service is only offered to returning tax payers.

Facilitated Free File is a "DIY" version.

The drop off service is only offered to returning tax payers.

Facilitated Free File is a "DIY" version.

There will only be one option for employee. If you look closely the employee for the first two weeks does have (Feb 1 - Feb 15) attached to the name. This is just for ease programming the scheduling system.

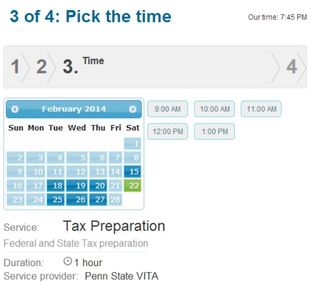

Date Color Code:

Green - The selected appointment day

Dark Blue - Available days

Light Blue - Unavailable days

Appointment Times

Each appointment time has 7 stations allotted. Therefore Taxpayer 1 and Taxpayer 2 can have the same appointment time. They will be assigned to different tax preparers.

Green - The selected appointment day

Dark Blue - Available days

Light Blue - Unavailable days

Appointment Times

Each appointment time has 7 stations allotted. Therefore Taxpayer 1 and Taxpayer 2 can have the same appointment time. They will be assigned to different tax preparers.

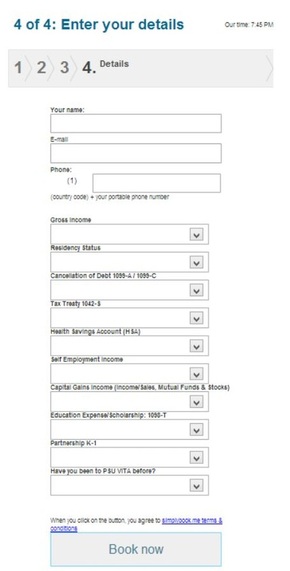

We are almost finished. This is the most important area that needs to be completed. Each question in this section must be answered before scheduling an appointment and it is used to ensure the taxpayer is qualified to receive our services.

- Gross Income: VITA has a limit that we can only serve tax payers with income no greater than $51,500.

- Residency Status: Our VITA site cannot process foreign tax returns. We will be referring anyone with a Non-Resident Alien Status to Global Connections in Boucke. Phone:

- Possible Income Issues:

Cancellation of Debt Tax Treaties

Health Savings Acct Self-Employment Income

Capital Gain Income Education Expense/Scholarship

Partnership K-1 - Tax Payers that are returning to our site can be processed much faster as some of their basic information is stored in our systems. Returning Tax Payers also have the option to drop off their papers.

Questions to Ask Callers:

1. Name (get correct spelling). Refer to master list of names for 2011 filers as needed.

2. Telephone number

3. Did they have taxes done with us last year (2011). Enter NO on the schedule if this is their first time to the PSU VITA site.

4. Are they U. S. citizens or resident aliens. (Resident aliens have lived in U.S. long enough to be treated as a U.S. taxpayer. If they are newcomers to the U.S. they should seek assistance from the Global Connections office in Boucke Bldg. (see footnote)

5. Date and time of appointment

6. Returning taxpayers can also DROP-Off their information. Those who want to do so will likely tell you. Only taxpayers whose returns were completed for the 2011 tax year can DROP- Off their returns and supporting tax documents. Those dropping off their returns will need to spend some time with a tax preparer to make sure all needed information has been provided. When they return to pick up the return, a preparer will go over the return with them before they leave.